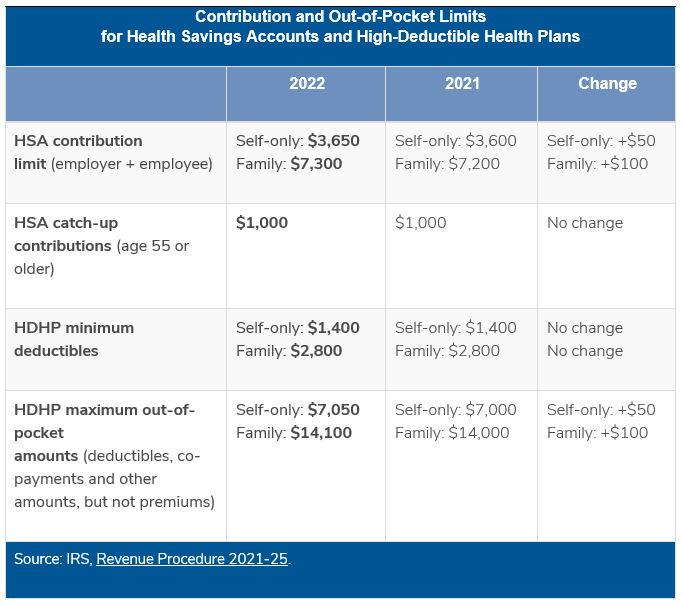

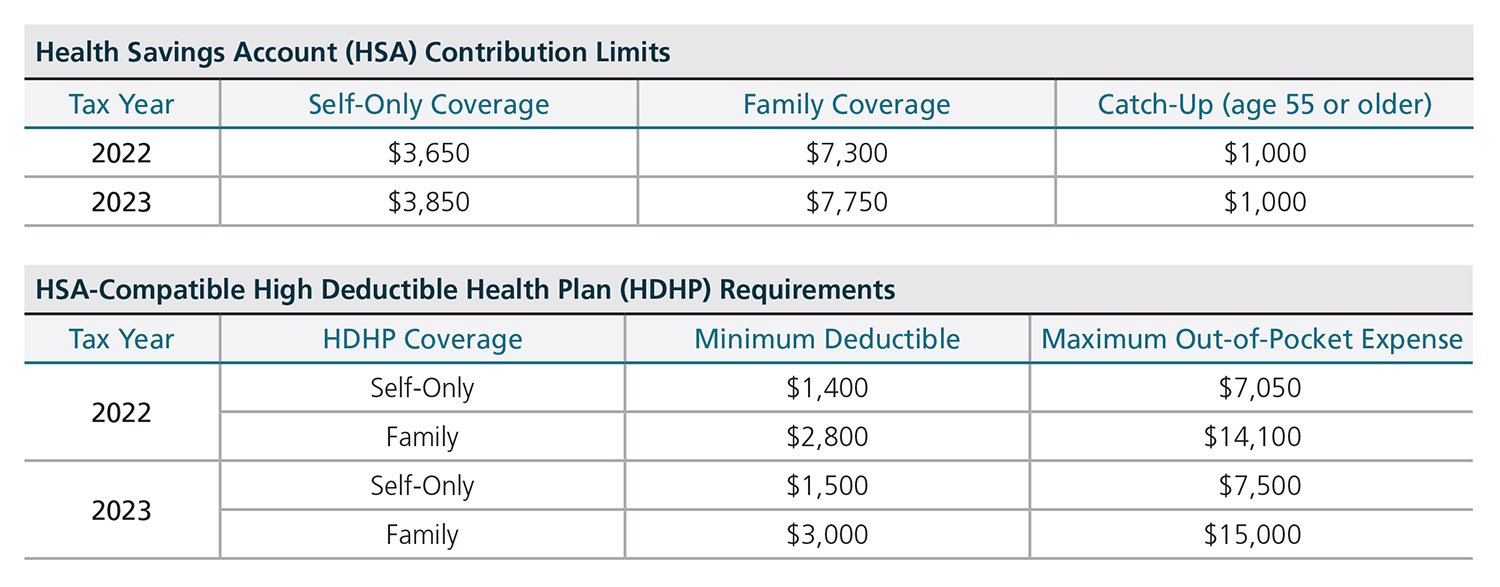

Irs Hsa Limits 2025 Over 55 - 2025 HSA Contribution Limits Claremont Insurance Services, (people 55 and older can stash away an. After the inflation adjustments, the 2025 hsa limits and thresholds are as follows: Irs Hsa Limits 2025 Over 55. The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. 2025 single plan family plan;.

2025 HSA Contribution Limits Claremont Insurance Services, (people 55 and older can stash away an. After the inflation adjustments, the 2025 hsa limits and thresholds are as follows:

Hsa Contribution Limits For 2025 And 2025 Image to u, At age 55, individuals can contribute an additional $1,000. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Irs Health Savings Account Limits 2025 Erika Jacinta, You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: Eligible individuals who are 55 or older by the end of the tax year can increase their contribution limit up to $1,000 a year.

After the inflation adjustments, the 2025 hsa limits and thresholds are as follows:

Hsa Max Contribution 2025 Over 55 Clara Demetra, The maximum contribution for family coverage is $8,300. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

+1500px.jpg?format=2500w)

2025 Hsa Contribution Limits Over 55 Over 60 Dollie Sylvia, (people 55 and older can stash away an. The irs released the 2025 inflation adjusted amounts for certain health plan limits.

The irs released the 2025 inflation adjusted amounts for certain health plan limits. Those age 55 and older can make an additional $1,000 catch.

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: The irs released the 2025 inflation adjusted amounts for certain health plan limits.

2025 Hsa Limits Explained Variance Norry Daniella, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Hsa Limit 2025 Over 55 Suki Zandra, For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2025. The hsa contribution limit for family coverage is $8,300.

Those age 55 and older can make an additional $1,000 catch.

Irs Guidelines For Hsa 2025 Belva Kittie, The hsa contribution limit for family coverage is $8,300. Those age 55 and older can make an additional $1,000 catch.

The irs recently announced a significant increase in hsa contribution limits for 2025.

Hsa Limits 2025 Family Over 55 Maire Roxanne, For a family plan, the limit is $8,300. You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: