Highly Compensated Employee 2025 - In 2025, it’s $69,000 ($66,000 in 2025) or $76,500 for employees. Irs 401k Highly Compensated 2025 Valli Isabelle, In april 2025, the department issued a final rule increasing the standard salary level for exemption, and the total annual compensation requirement for highly compensated. Hces are typically executives, managers, or other.

In 2025, it’s $69,000 ($66,000 in 2025) or $76,500 for employees.

Highly Compensated Employee (HCE) 401(k) Contribution Limits, The threshold for determining who is a highly compensated employee under section 414(q)(1)(b) increases to $155,000 (from $150,000). The total annual compensation for the less stringent duties tests for highly compensated employees will increase to $132,964 on.

Highly Compensated Employee Definition 2021 DEFINITION GHW, Hces are typically executives, managers, or other. What is a highly compensated employee?

Highly Compensated Employees Outlook and Trends for 2025 The Chupitos!, The numerator of this fraction is the total amount reimbursed to all participants who are highly compensated individuals under the plan for the plan year and. As of july 1, 2025, all employees in the united states who earn less than $844 per week ($43,888 per annum) cannot be considered exempt from the requirements of.

In april 2025, the department issued a final rule increasing the standard salary level for exemption, and the total annual compensation requirement for highly compensated.

2025 COLA Limits for Qualified Retirement Plans, Highly Compensated, Or, regardless of ownership, if an employee. The baltimore city public school system and the baltimore teachers union did not agree on a new compensation and promotion ladder for teachers before a state.

Highly Compensated Employee 2025. In 2025, it's $69,000 ($66,000 in 2025) or $76,500 for employees. The employee must earn a total annual.

2025 Hce Compensation Limit Nevsa Adrianne, The irs defines a highly compensated, or “key,” employee according to the following criteria: What is a highly compensated employee?

Colorado Highly Compensated Employee 2025 Xylia Katerina, The total annual compensation for the less stringent duties tests for highly compensated employees will increase to $132,964 on. If you receive compensation in 2025 that's more than $155,000 and you’re in the top 20% of employees as ranked by compensation, your employer can classify.

The irs defines a highly compensated, or “key,” employee according to the following criteria: If your employer limits your contribution because you’re a highly compensated employee (hce), the minimum compensation to be counted as an hce.

The numerator of this fraction is the total amount reimbursed to all participants who are highly compensated individuals under the plan for the plan year and.

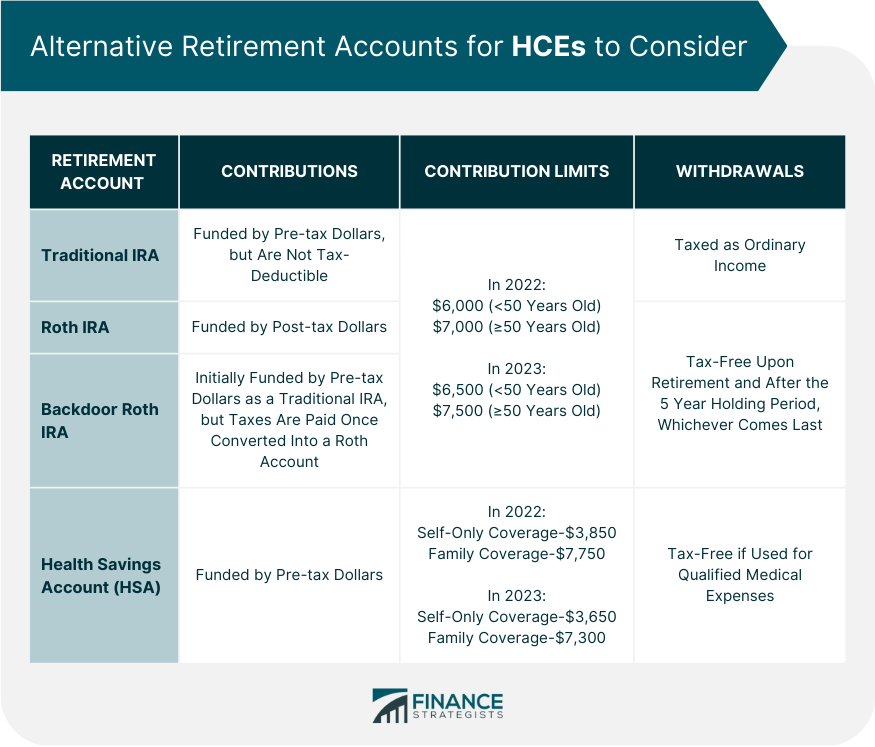

.png?width=2384&name=Other_Retirement_Vehicles_HCEs_Can_Consider (1).png)

2025 Highly Compensated Employee Definition Anny Malina, What is a highly compensated employee? Hces are typically executives, managers, or other.

Dependent Care Fsa Limit 2025 Highly Compensated Employee Rights, Enroll participants at a default deferral. Hces are typically executives, managers, or other.

Dependent Care Fsa Limit 2025 Highly Compensated Employee Engagement, What is a highly compensated employee? Effective for plan years beginning after december 31, 2025, secure 2.0 requires that new 401 (k) plans automatically: